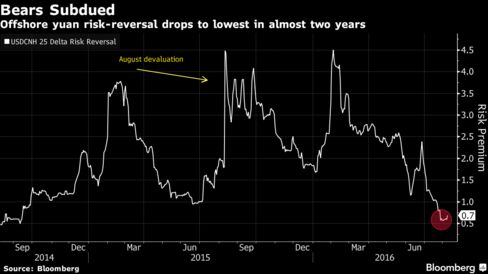

While the yuan has continued to decline, both against the dollar and a basket of trading partners, investor panic has dissipated. Options traders are the least bearish on the yuan in almost two years, outflows have slowed and a gauge of volatility has declined to its lowest level since November, according to Bloomberg.

Global investors have become less concerned about a weaker yuan as China’s central bank improved its communication and stepped into the market to prevent a spiral of depreciation and outflows. While the People’s Bank of China appears to have restored stability before the yuan’s inclusion in the International Monetary Fund’s basket of reserve currencies, the intervention has come at a cost: The yuan’s share of global payments fell in June to the lowest level in almost two years.

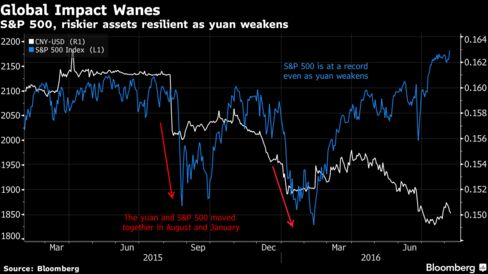

The yuan’s 1.8 percent drop on Aug. 11 in Shanghai was the currency’s biggest in two decades, and the plunge rippled through global markets. While panic abated within weeks as the PBOC intervened via agent banks and signaled that the yuan had fallen enough, the central bank reignited fear of a currency war in January by cutting the yuan’s reference rate for eight days in a row.

The pace of declines has since moderated and the impact on world markets has become negligible. While the yuan is within 1 percent of a five-year low against the dollar, the S&P 500 Index has climbed to an all-time high.

China’s efforts to limit capital outflows are also paying off. The nation’s foreign-exchange reserves were little changed in July as the central bank burned through less of the hoard to defend its currency. The yuan is projected to fall a further 1.3 percent by the end of the year, according to analyst estimates compiled by Bloomberg.

Pledges by the central bank to keep the yuan stable against peers is also finding greater traction with investors. The currency’s three-month implied volatility, which is used to price options, dropped to 4.6 percent on Friday to its lowest level since November in Hong Kong, according to data compiled by Bloomberg.

Still, market intervention and persistent weakness in the yuan have undermined the government’s efforts to expand its global use. The Chinese currency accounted for 1.72 percent of transactions in June, the smallest portion since October 2014, according to the Society for Worldwide Interbank Financial Telecommunications. Yuan deposits in Hong Kong fell to the lowest since August 2013 in June.