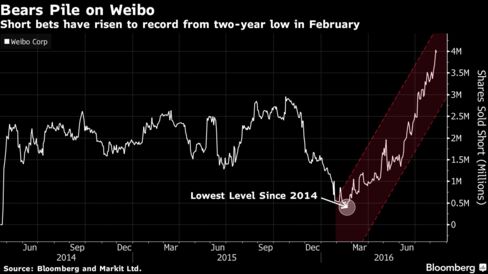

Bearish bets on Weibo, the Asian nation’s answer to Twitter Inc., are at the highest ever, even after the company reported earnings that beat analysts estimates and forecast a bigger-than-expected increase in third-quarter revenue. The U.S.-traded stock posted a 19 percent gain last week, while the number of shares borrowed for short selling rose to a record 4 million, according to Bloomberg.

Bullish investors are betting that television and video partnerships the company has been forging will further boost the number of people using Weibo, which has been growing at a steady rate of about 30 percent for the past two years. Short sellers are wagering that a 119 percent rally this year, twice as much as the second-biggest gainer among Chinese stocks in the U.S., has become excessive.

“There is a lot of optimism regarding Weibo,” Henry Guo, an analyst at New York-based M Science LLC who has been covering Chinese American depositary receipts for a decade, said by phone last week. “Investors bet that it has a potential to expand and monetize its business. The question short-sellers are asking is, ‘Can the stock rally last forever?’ ”

Since it was spun off from Sina Corp. in April 2014, Weibo’s stock has rallied 151 percent. Sina’s ADRs gained 33 percent during the same period.

Weibo, backed by Alibaba Group Holding Ltd., has been adding video content live-streaming features to its microblogging service, which helped boost the number of monthly active users to 282 million in the second quarter, Chief Executive Officer Gaofei Wang said in the second-quarter earnings statement last week. The company projected third-quarter revenue of as much as $178 million, exceeding analysts’ estimates of $165 million.

The shares sell for 49 times projected earnings, above the average multiple of 42 among nine global peers, including Twitter and Facebook Inc., according to data compiled by Bloomberg. David Riedel, a president of New York-based Riedel Research Group Inc., who cut Weibo to sell from buy in May, said by e-mail last week that he’s negative on the stock mostly because it’s “cheaper to buy the Weibo exposure via Sina.”

Other analysts from banks including Citigroup Inc. and Jefferies Group have recently raised their recommendations to buy. Weibo’s second-quarter per-share earnings rose to 16 cents, compared with an estimate of 11 cents.

This is good news for KraneShares’ Brendan Ahern, who has been increasing his position in the stock this year.

“There is a potential in Weibo,” Ahern, chief investment officer at KraneShares, said in an interview in New York. “The company’s fundamentals are solid and there is room for growth.”